With e-commerce rising during the pandemic and reduced opportunities to physically conduct consumer research, Attention Insight’s platform for predicting attention to visuals has attracted investment from venture capital funds, as well as receiving additional funding to improve its innovative technologies.

Having grown to over 5,000 users across the US, German, Scandinavian and other markets, Attention Insight attracted 285,000 euros in investment from the venture capital funds Movens VC (Poland) and Open Circle Capital (Lithuania) in December. Another 421,000 euros were issued to the company last autumn by LVPA for incentivising R&D and innovations, including improving AI technologies and gathering new data on eye movement.

Attention Insight CEO and co-founder Kamilė Jokubaitė comments that the funding drawn from investors will primarily be allocated to expanding into new markets and developing and improving features.

“We hope to reach 15,000 users this year – marketing professionals, agencies, news media outlets, and e-commerce companies. We will focus more on the massive and particularly promising Polish market and Polish agencies via our Warsaw branch. Still, we are not limiting ourselves geographically and look to grow around the world. We will continue to perfect the product’s functionality, datasets, technologies based on artificial intelligence and deep learning. We will also seek new opportunities in the particularly pertinent mobile device market,” K. Jokubaitė says.

According to her, the pandemic has accelerated the transition of businesses toward e-commerce and questions on user experience optimisation are more important online than in physical stores. For this reason, the artificial intelligence solutions offered by Attention Insight, which allow for effective consumer research without their direct involvement, have vast potential in the competitive and rapidly growing market.

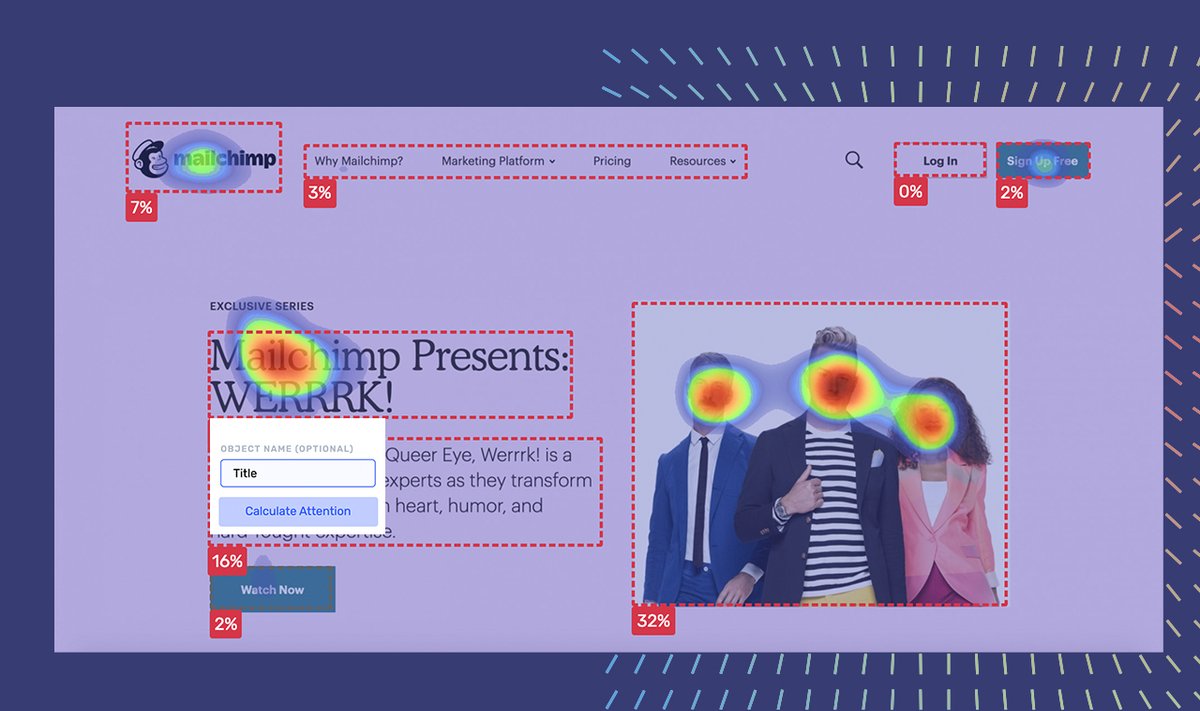

Attention Insight helps users automatically detect which design elements found on websites, outdoor adverts, or other environments attract users’ attention the most. The company’s product analyses the imagery and offers recommendations based on a database of more than 30,000 images assessed in eye-tracking studies. Thus, results are obtained immediately without service users needing to invest in their equipment and research. Based on the Massachusetts Institute of Technology (MIT) model, which is held to be the market standard, 90-94% accuracy has been achieved compared to regular eye tracking studies.

Attention Insight’s product already has integration with Adobe XD and Sketch tools, which are particularly relevant to the design community, while also having a Chrome plugin. Users are offered heatmaps for their websites or other visual materials, clarity scoring, various recommendations, possibilities for comparisons, and more.

Artur Banach, Partner at Movens VC, believes that Attention Insight will revolutionize how marketers, graphic designers, or UX/UI specialists work on campaigns or websites. He is also happy that the company will strengthen its operations in Poland due to Movens’ investment.

"Thanks to its pre-launch design analytics, any creative can be optimized X100 faster, X100 more cost-effective, and the most important in many cases before their launch. We are amazed by the company's global traction (5000+ users), enthusiastic reviews from customers, and excellent results of campaigns on Appsumo or ProductHunt," says A. Banach.

“We are thrilled to continue backing Attention Insight as we believe that their technology and products have great potential in a more and more visual-oriented business and consumer world,” seconds Jens Damsgaard, partner at Open Circle Capital.

Attention Insight attracted its first investment in the summer of 2019. Back then, investment was received from the Lithuanian business angel network LitBAN as well as Lithuanian VC funds Koinvesticinis Fondas and fund Open Circle Capital.

Currently, the company’s team is comprised of eight staff members and partners in Vilnius and Warsaw. The team is expected to double in the next few quarters.